Fintech applications are becoming increasingly important in today’s world for a number of compelling reasons. Firstly, they offer a level of convenience and flexibility to consumers that is unparalleled. Users are able to manage their finances from any location and at any time thanks to the rise of mobile banking. With this technology, users are able to easily access their accounts, transfer money, and pay bills without the need to visit a physical bank branch.

Also Read: 5 Ways to Boost Your Mobile App’s Retention Rate

Secondly, fintech apps are often a more affordable option than traditional financial services. Numerous fintech companies offer lower fees and interest rates, making financial services more accessible to a wider range of consumers. Also, fintech apps frequently employ data analysis and automation to simplify financial processes, which in turn reduces costs and increases efficiency. In this article, you will learn what is required to successfully finish the fintech app development process.

Everything You Need to Know About Fintech Applications

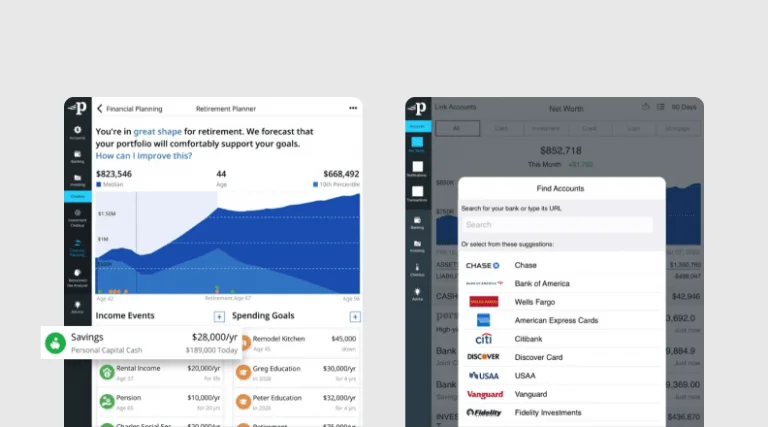

Fintech apps, also known as financial technology applications, are software programs that offer users financial services through digital channels. These innovative apps leverage cutting-edge technologies such as artificial intelligence, machine learning, and blockchain to provide users with a range of financial services.

One of the main reasons why fintech apps are so important is their high level of convenience and accessibility. Users can easily manage their finances from anywhere and at any time without needing to visit physical bank branches or other financial institutions. This flexibility is especially important for people with busy schedules or those living in areas with limited access to traditional financial services.

Fintech apps can be divided into several different types, including payment apps, investment apps, budgeting apps, and lending apps. Payment apps enable users to send and receive money electronically, while investment apps provide users with access to investment opportunities and portfolios. Budgeting apps help users manage their finances by tracking their spending and setting financial goals, and lending apps offer users loans through digital platforms.

Also Read: Best SNES Emulator for Android & Windows 10

The functionality of fintech apps can vary widely depending on their purpose and design. Some apps offer basic features such as managing accounts, transferring funds, and paying bills, while others provide more advanced functionalities such as financial planning tools and automated investing. Additionally, fintech apps often utilize data analytics and automation to streamline processes, improve efficiency, and reduce costs.

Reasons to Invest in Fintech App Development

We can see that there are several compelling reasons why businesses are choosing to invest in fintech app development, and these reasons are exemplified by some of the successful fintech apps that have already hit the market.

Fintech apps provide companies with a competitive edge by offering innovative financial services that traditional banks and financial institutions may not offer. For instance, Robinhood, a popular investment app, offers commission-free stock trading, which has disrupted the traditional brokerage industry. By investing in fintech app development, companies can offer unique and innovative services that attract new customers and differentiate themselves from competitors.

Moreover, such applications help businesses reach new audiences and demographics. For example, Chime, a mobile banking app, targets millennials and offers unique features like early access to paychecks and automatic savings plans. By targeting specific customer segments and offering tailored services, companies can tap into new markets and expand their customer base.

Also Read: 10 Selenium Python Best Practices for Web Testing

What is more important, fintech applications furnish enterprises with valuable data insights that can inform business decisions and improve customer experiences. For instance, Mint, a budgeting app, analyzes user spending habits and provides personalized financial advice. By collecting and analyzing user data, companies can better understand customer needs and preferences, and make data-driven decisions.

Lastly, fintech apps can help companies reduce costs and improve efficiency by automating financial processes. For instance, TransferWise, a money transfer app, uses automation to match customers with other customers who need to exchange currencies, reducing the need for expensive intermediaries. By automating financial processes, companies can reduce costs and improve scalability.

Fintech App Development: The Benefits and Drawbacks

Although fintech is rapidly advancing, there are still areas for improvement. Along with the obvious benefits, there are drawbacks that must be considered before embarking on the fintech app development process. Let’s examine them more closely:

Benefits:

- Increased Access to Financial Services: Fintech apps have made it easier for people, especially those in remote or underbanked areas, to access financial services. For example, M-Pesa, a mobile money transfer app, has brought financial services to millions of unbanked people in Kenya and other African countries.

- Cost Savings: Fintech apps can significantly reduce costs compared to traditional financial services by automating processes and eliminating intermediaries. Venmo, a popular payment app, is an example that allows users to send and receive money without transaction fees.

- Personalization: Fintech apps can provide personalized financial services by using data analytics and machine learning. Wealthfront, a robot-advisor app, uses algorithms to create personalized investment portfolios based on user preferences and risk tolerance.

- Innovation: Fintech apps have disrupted the financial industry by offering new and innovative services that traditional banks and financial institutions may not offer. Square, a payment processing app, has introduced new services like instant deposits and invoice management.

Drawbacks:

- Security Risks: Fintech apps can be vulnerable to security breaches and hacking attacks, potentially compromising users’ personal and financial information. The Equifax data breach in 2017 exposed the personal information of millions of customers, serving as a cautionary tale.

- Regulatory Challenges: Fintech apps operate in a heavily regulated industry, and complying with regulations can be a challenge. LendingClub, a peer-to-peer lending app, faced regulatory challenges and legal action from the Securities and Exchange Commission.

- Limited Services: Fintech apps may not offer the same range of services as traditional financial institutions, and some users may prefer the familiarity and reliability of traditional services. For example, some users may prefer to visit a physical bank branch to open an account or apply for a loan.

- Reliance on Technology: Fintech apps rely heavily on technology, and technical issues or system failures can disrupt service and cause inconvenience to users. The outage of the Robinhood app in 2021 prevented users from trading during a critical market period, highlighting the importance of robust technology infrastructure.

From Idea to Launch: The 8-Step Plan for Fintech App Development

- Market research: Conducting thorough research to identify the target audience, competition, and market demand is crucial before starting any fintech app development.

- Defining Scope & Requirements: Clearly defining the app’s features, functionalities, and user interface design based on market research.

- Architecture Design: Creating a solid technical blueprint of the app’s infrastructure, including the database, APIs, and server, to ensure scalability and security.

- Development: Building the app’s front-end and back-end, including coding, testing, and debugging to ensure the app is functional and user-friendly.

- Integration: Connecting the app to third-party services such as payment gateways and banking APIs, to enhance its capabilities and user experience.

- Testing & Quality Assurance: Performing extensive testing and quality assurance to detect and fix any bugs or errors and ensure the app works smoothly.

- Deployment: Releasing the app to the market and making it available for download on app stores.

- Maintenance: Providing continuous technical support, fixing bugs, and adding new features as needed to ensure the app remains relevant and competitive.

Conclusion

Fintech app development can be a highly lucrative startup opportunity due to the rapidly growing industry and high demand for innovative financial solutions. By leveraging advanced technologies like artificial intelligence and blockchain, fintech apps can provide unique advantages and disrupt the traditional financial industry. However, to succeed in this competitive market, it is crucial to conduct thorough market research, adhere to industry regulations, and develop a solid business plan.